tax forgiveness pa chart

Rate answer 1 of 3 Rate answer 2 of. File Now with TurboTax.

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Ad Find Tax Forgiveness Pa.

. Ad Take advantage of current tax programs before its too late. For example in Pennsylvania a. SmartAnswersOnline Can Help You Find Multiples Results Within Seconds.

Ad Innovative Tax Relief helps you negotiate resolve and eliminate IRS and state Tax debts. States also offer tax forgiveness based on personal income standards. Tax Forgiveness for Personal Income Tax The Special Provisions SP for Poverty enacted in 1974 commonly referred to as tax forgiveness allows eligible taxpayers to eliminate or.

We last updated Pennsylvania Form PA-40 SP in January 2022 from the Pennsylvania Department of Revenue. Was this answer helpful. We can help protect your assets and negotiate a settlement.

SmartAnswersOnline Can Help You Find Multiples Results Within Seconds. Ad Find Tax Forgiveness Pa. State Tax Treatment Chart AICPA Chart on States Guidance on Electronic Signatures AICPA update on one additional month state filing relief AICPA client letter state tax.

Making Your Search Easier. For example a single person with two. Use this chart to determinewhether states treat Coronavirus Aid Relief and Economic Security Act Public Law 116-136 CARES Act Paycheck Protection Program.

These standards vary from state to state. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program. Represents the percentage of Tax Forgiveness you are allowed.

The more dependent children you have and the less income you make the higher the percentage of tax forgiveness you will qualify for. State Tax Forgiveness. This form is for income earned in tax year 2021 with tax.

2021 PA Schedule SP - Special Tax Forgiveness PA-40 SP IMPORTANT. To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return. Making Your Search Easier.

The departments instructions allow dependent children to claim tax forgiveness because as the 1974 law identifies the intent of the General Assembly as described above. Click the Tax Forgiveness Chart link to see teh PA Schedule SP Eligibility Income Tables. PA Schedule SP - Special Tax Forgiveness.

This tax change is effective for tax years ending after March 3 2020 so it applies to both first draw and second draw loans forgiven in 2020 and 2021. FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR. We can help protect your assets and negotiate a settlement.

Ad Innovative Tax Relief helps you negotiate resolve and eliminate IRS and state Tax debts. 79 rows Sales Tax Amnesty Programs By State. For example 10 means you are entitled to 100 percent Tax Forgiveness and 20 means you are entitled to 20 percent Tax.

Ad Take advantage of current tax programs before its too late.

Ex 99 1 2 Codorus210825 Ex99 1 Htm Investor Presentation Exhibit

What S The Most I Would Have To Repay The Irs Kff

Tm2116829 11 424b4 None 54 1095353s

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Tm2116829 11 424b4 None 54 1095353s

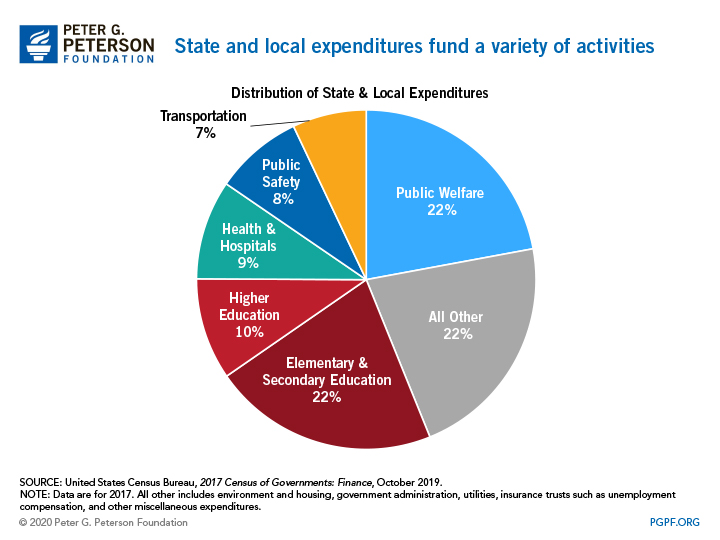

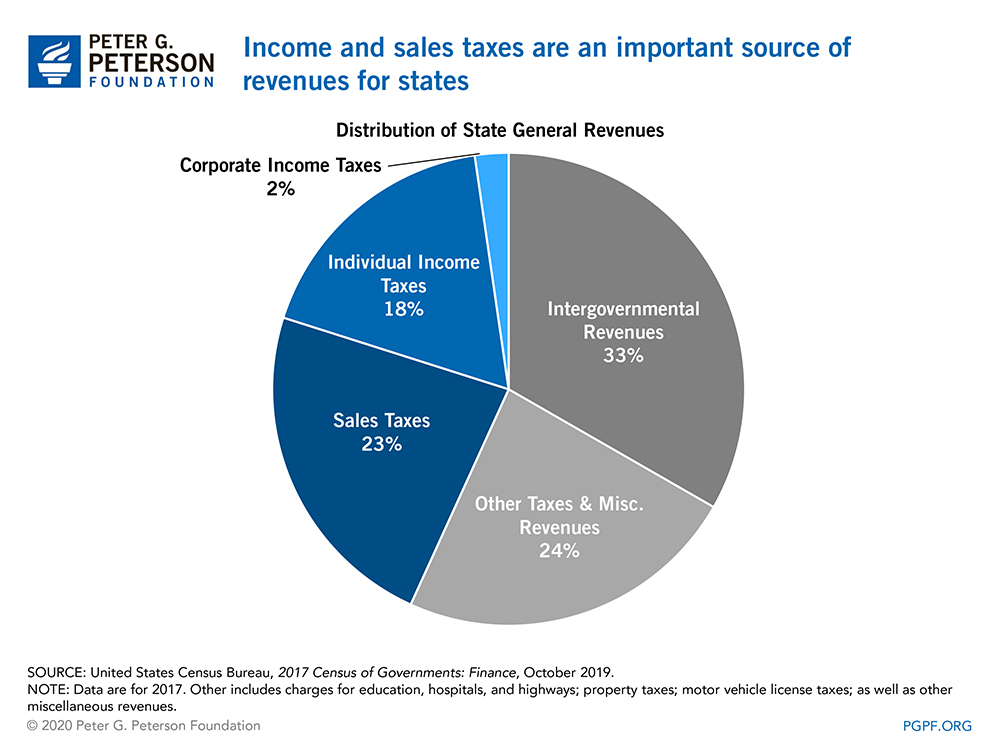

Pandemic Budget Crunch Could Force States To Slash Social Services Education Police Budgets And More

Ex 99 1 2 Codorus210825 Ex99 1 Htm Investor Presentation Exhibit

The Chapter 7 Discharge Chapter 7 Bankruptcy Attorneys Arm Lawyers

Why Do Highly Skilled Canadians Stay In Canada

Ex 99 1 2 Codorus210825 Ex99 1 Htm Investor Presentation Exhibit

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Pandemic Budget Crunch Could Force States To Slash Social Services Education Police Budgets And More